To set up accounting books for a small business, choose accounting software and create a chart of accounts. Record all financial transactions accurately.

Starting a small business involves meticulous financial management. Proper accounting setup is crucial for tracking income, expenses, and ensuring compliance. Selecting the right accounting software simplifies this process, making it easier to manage finances. A well-structured chart of accounts categorizes all financial transactions, providing clear insights into the business’s financial health.

Regularly updating and reviewing these records helps in making informed decisions. Accurate accounting not only aids in tax preparation but also in identifying growth opportunities. By maintaining organized books, small business owners can focus on growth while staying financially sound.

Credit: www.amazon.com

Introduction To Small Business Accounting

Starting a small business is exciting and challenging. One essential task is setting up accounting books. Proper accounting helps track income and expenses. It ensures financial health and compliance with regulations.

Importance Of Accurate Accounting

Accurate accounting is crucial for any small business. It helps you understand your financial position. You can see where your money comes from and where it goes. Errors in accounting can lead to financial losses and missed opportunities.

Accurate records are required by law. They help you prepare for tax season. You avoid penalties and fines by keeping accurate books. Good accounting practices also build trust with investors and lenders.

Impact On Business Decisions

Accurate accounting influences important business decisions. With clear financial data, you make informed choices. You can decide on future investments or cut unnecessary costs. It helps you understand which products or services are profitable.

Good accounting practices help in budgeting. You can set realistic financial goals. Financial statements provide insights into business performance. They help you identify trends and plan for growth.

| Accounting Task | Purpose |

|---|---|

| Recording Transactions | Track income and expenses |

| Preparing Financial Statements | Understand financial health |

| Tax Filing | Comply with legal requirements |

Choosing The Right Accounting Method

Choosing the right accounting method is crucial for small business success. Your accounting method affects tax filings, financial planning, and daily operations. Here’s a guide to help you understand the options and decide what fits your business best.

Cash Basis Vs. Accrual Basis

There are two main accounting methods: cash basis and accrual basis. Each has its pros and cons.

| Cash Basis Accounting | Accrual Basis Accounting |

|---|---|

| Records income and expenses when cash is received or paid. | Records income and expenses when they are earned or incurred. |

| Simpler and more straightforward. | Provides a more accurate financial picture. |

| Better for small businesses with simple transactions. | Better for businesses with complex transactions or inventory. |

Factors To Consider

When choosing an accounting method, consider these factors:

- Business Size: Smaller businesses may prefer the simplicity of cash basis.

- Complexity: Larger businesses with more transactions may benefit from accrual basis.

- Tax Implications: Different methods can affect your taxable income.

- Financial Reporting: Accrual basis provides a clearer financial picture.

- Regulatory Requirements: Some industries have specific accounting method requirements.

Choosing the right accounting method can help streamline your financial processes. Make sure to consider all factors to make an informed decision.

Setting Up Your Accounting System

Setting up your accounting system is crucial for small business success. Proper accounting helps track income, expenses, and financial health.

Whether you choose manual or software solutions, ensure your system is accurate and efficient. Below, we explore the options and essential features.

Manual Vs. Software Solutions

Manual accounting involves recording transactions by hand. It uses ledgers, journals, and calculators. This method is time-consuming and prone to errors. It’s suitable for very small businesses with few transactions.

Software solutions offer automation and accuracy. They save time and reduce errors. Popular options include QuickBooks, Xero, and FreshBooks. Software solutions provide real-time updates and easy reporting.

Below is a comparison table:

| Feature | Manual Accounting | Software Solutions |

|---|---|---|

| Setup Cost | Low | Moderate to High |

| Time Efficiency | Poor | Excellent |

| Accuracy | Variable | High |

| Scalability | Limited | High |

Essential Accounting Software Features

Choosing the right accounting software is important. Here are the essential features to look for:

- Invoicing – Generate and send professional invoices quickly.

- Expense Tracking – Automatically track and categorize expenses.

- Bank Reconciliation – Match transactions with bank statements.

- Financial Reporting – Create balance sheets, profit/loss statements, and cash flow reports.

- Payroll Management – Handle employee payments and tax deductions.

- Tax Preparation – Simplify tax filing with accurate records.

- Multi-User Access – Allow multiple users with different access levels.

Ensure the software integrates with other tools you use. Integration with payment processors, CRM systems, and e-commerce platforms can streamline operations.

Understanding Basic Accounting Principles

Setting up accounting books is vital for small businesses. Understanding basic accounting principles helps manage finances effectively. This guide covers essential concepts for small business accounting.

Double-entry Bookkeeping

Double-entry bookkeeping is a key accounting principle. It means every transaction affects two accounts. One account is debited, and the other is credited. This system ensures accuracy and balance.

For example, if you buy office supplies for $100, you would:

- Debit Office Supplies $100

- Credit Cash $100

Double-entry bookkeeping helps track all financial transactions. It prevents errors and maintains accurate records.

The Accounting Equation

The accounting equation is the foundation of accounting. It states:

Assets = Liabilities + Owner's EquityThis equation ensures that the balance sheet remains balanced. Every financial transaction affects this equation.

For example, if you take a loan of $5000 to buy equipment:

| Account | Amount |

|---|---|

| Assets (Equipment) | $5000 |

| Liabilities (Loan) | $5000 |

The accounting equation helps understand the financial position. It shows what the business owns and owes.

Organizing Chart Of Accounts

Organizing your chart of accounts is crucial for small business success. It ensures financial data is clear and easy to track. This guide will help you set up an efficient chart of accounts.

Designing Your Chart Of Accounts

Start by designing a simple and logical chart of accounts. This framework will categorize all your financial transactions. A well-organized chart of accounts simplifies financial reporting and tax preparation.

Use a consistent numbering system. For example:

- 1000-1999: Assets

- 2000-2999: Liabilities

- 3000-3999: Equity

- 4000-4999: Revenue

- 5000-5999: Expenses

Each category should have a unique number range. This helps in organizing and retrieving data quickly.

Categories And Subcategories

Next, identify the main categories relevant to your business. Common categories include:

- Assets

- Liabilities

- Equity

- Revenue

- Expenses

Create subcategories under each main category. For example, under Assets, you might have:

- Cash

- Accounts Receivable

- Inventory

Under Expenses, you might include:

- Rent

- Utilities

- Supplies

Subcategories help in detailed tracking of financial data. This ensures you have a clear picture of where money is going.

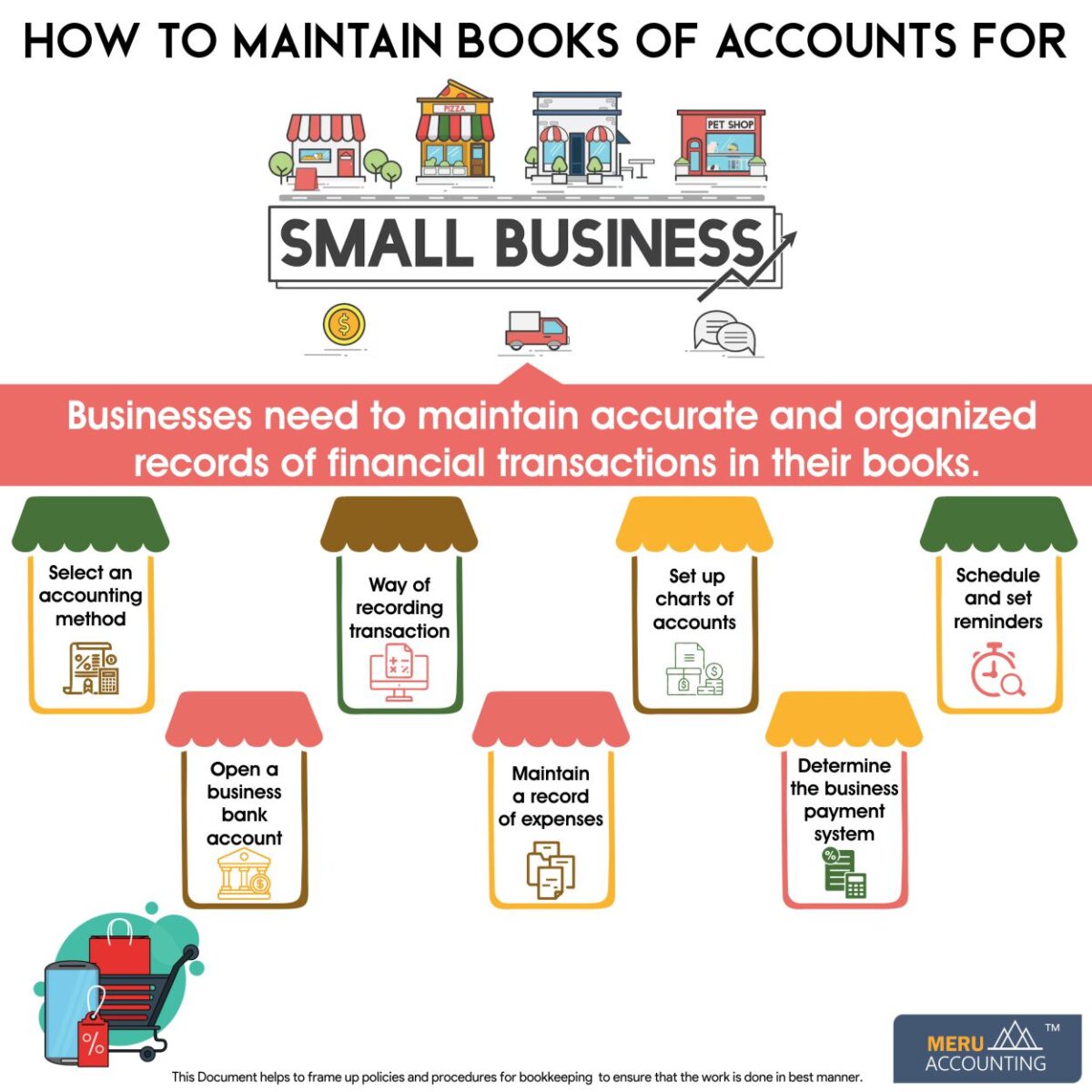

Credit: www.meruaccounting.com

Recording Daily Transactions

Recording daily transactions is crucial for every small business. It ensures accurate financial records and smooth operations. This section will guide you through managing invoices and receipts, and tracking expenses and sales.

Managing Invoices And Receipts

Invoices and receipts are essential for keeping track of business activities. They help you monitor income and expenses efficiently.

- Create and send invoices immediately after completing a service or sale.

- Organize receipts by date and category to avoid confusion.

- Use digital tools for recording and storing invoices and receipts.

Using accounting software can simplify this process. It can automate invoice generation and storage. This saves time and reduces errors.

Tracking Expenses And Sales

Properly tracking expenses and sales is vital for understanding your business’s financial health. It helps you plan for growth and avoid cash flow issues.

- Record every expense, no matter how small, immediately.

- Track sales daily to monitor business performance.

- Use spreadsheets or software to keep records organized.

To make tracking easier, use categories like supplies, utilities, and marketing. This categorization helps in better analysis and reporting.

| Category | Description |

|---|---|

| Supplies | Office supplies, tools, and equipment |

| Utilities | Electricity, water, and internet bills |

| Marketing | Advertising and promotion costs |

Regularly review your records to spot trends and make informed decisions. Keeping your books up-to-date ensures your business runs smoothly.

Handling Payroll And Employee Expenses

Handling payroll and employee expenses is crucial for small businesses. Proper management ensures accuracy and compliance with tax laws. This section will guide you through setting up payroll systems and managing employee reimbursements.

Setting Up Payroll Systems

Setting up a payroll system is essential for any small business. It ensures employees are paid accurately and on time. Follow these steps:

- Choose a Payroll Service: Select a reliable payroll service provider. Options include Gusto, QuickBooks Payroll, and ADP.

- Gather Employee Information: Collect necessary details like Social Security numbers, tax withholding forms, and bank account information.

- Set Up Payroll Schedule: Decide on a payroll schedule that suits your business needs. Common options are weekly, bi-weekly, or monthly.

- Calculate Payroll Taxes: Ensure accurate calculation of federal, state, and local taxes.

- Run Payroll: Process payroll based on the schedule and ensure timely payment.

Managing Employee Reimbursements

Employee reimbursements cover expenses employees incur during business activities. Proper management is essential for accurate accounting. Follow these tips:

- Develop a Reimbursement Policy: Create a clear policy outlining eligible expenses and the reimbursement process.

- Collect Receipts: Require employees to submit receipts for reimbursement claims.

- Use Expense Tracking Software: Utilize software like Expensify or Zoho Expense for efficient tracking.

- Review and Approve Claims: Ensure thorough review and approval of all reimbursement claims.

- Record Reimbursements: Accurately record reimbursements in your accounting books.

Handling payroll and employee expenses may seem complex. With the right systems and practices, it becomes manageable and ensures financial accuracy.

Preparing Financial Statements

Preparing financial statements is crucial for small businesses. They provide a clear view of your financial health. This section covers the essentials of creating financial statements.

Income Statement Basics

The income statement shows your revenue and expenses over a period. It helps track profitability. You need to list all sources of income. Include sales, services, and other income.

Next, record all your expenses. This includes costs of goods sold, operating expenses, and taxes. Subtract total expenses from total income. The result is your net income.

| Income | Amount |

|---|---|

| Sales | $10,000 |

| Services | $2,000 |

| Other Income | $500 |

| Total Income | $12,500 |

| Expenses | Amount |

|---|---|

| Cost of Goods Sold | $4,000 |

| Operating Expenses | $3,000 |

| Taxes | $1,000 |

| Total Expenses | $8,000 |

Net Income = Total Income – Total Expenses = $12,500 – $8,000 = $4,500

Balance Sheet And Cash Flow Statement

The balance sheet provides a snapshot of your business’s financial position. It includes assets, liabilities, and equity.

Assets include cash, inventory, and equipment. List all assets with their values. Total them up.

Liabilities are what you owe. This includes loans and accounts payable. List all liabilities and total them.

Equity is what remains after liabilities. This is calculated as: Equity = Total Assets – Total Liabilities.

The cash flow statement tracks the movement of cash in and out. It includes cash from operations, investing, and financing.

- Cash from operations: daily business activities.

- Cash from investing: buying or selling assets.

- Cash from financing: loans, stock issuance, etc.

Summarize these to understand your net cash flow.

Regular Accounting Maintenance

Regular accounting maintenance ensures your small business’s financial health. Proper maintenance helps you avoid costly errors and stay compliant. Here’s how to stay on top of your accounting tasks.

Reconciling Bank Statements

Reconciling bank statements is crucial for accurate records. Compare your bank statement with your accounting books. Ensure all transactions match. Look for discrepancies and resolve them promptly.

Steps to reconcile bank statements:

- Gather your bank statements and accounting records.

- Compare deposits, withdrawals, and ending balances.

- Identify and investigate any discrepancies.

- Adjust your records to match the bank statement.

Periodic Review And Audit

Periodic reviews and audits maintain the integrity of your books. Regular reviews catch errors early. Audits ensure compliance with regulations.

Steps for effective reviews and audits:

- Conduct monthly reviews of your financial statements.

- Check for unusual or unexpected transactions.

- Ensure all entries are backed by proper documentation.

- Schedule annual audits to verify accuracy and compliance.

Maintaining regular accounting practices keeps your small business on track. Stay diligent and organized to ensure financial success.

Tax Planning And Compliance

Setting up accounting books for a small business is crucial. One key aspect is Tax Planning and Compliance. Proper tax management ensures your business remains compliant and avoids penalties. It also helps in efficient financial planning and saving money.

Understanding Tax Obligations

As a small business owner, you need to understand your tax obligations. These include various types of taxes your business must pay:

- Income Tax

- Sales Tax

- Payroll Tax

- Self-Employment Tax

Income tax is based on your business’s net income. Sales tax is collected from customers on taxable sales. Payroll tax is for your employees’ wages. Self-employment tax covers Social Security and Medicare.

Each tax type has specific filing deadlines and rates. Missing these can result in fines. Ensure you know the deadlines and rates for each tax.

Strategies For Efficient Tax Planning

Efficient tax planning can save your business money. Here are some strategies to consider:

- Keep Accurate Records: Maintain detailed and accurate financial records.

- Hire a Professional: Consider hiring a tax professional or accountant.

- Utilize Tax Software: Use tax software to simplify the process.

- Take Advantage of Deductions: Identify and claim all eligible deductions.

- Plan for Quarterly Taxes: Make quarterly estimated tax payments.

Accurate records help in identifying tax deductions. A professional can provide valuable advice. Tax software can automate calculations and ensure accuracy. Deductions reduce your taxable income. Quarterly payments prevent a large tax bill at year-end.

Efficient tax planning ensures your business stays compliant and saves money. It also helps you avoid unexpected tax bills and penalties.

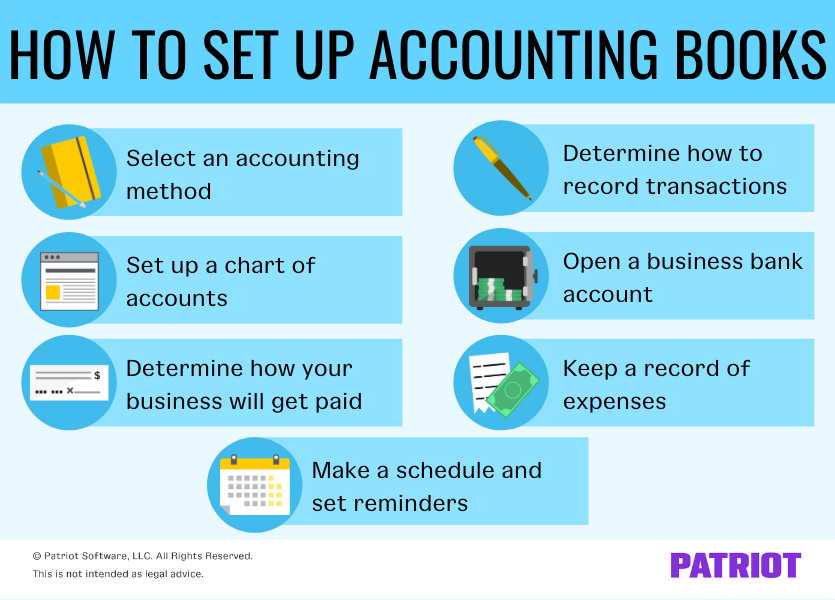

Credit: www.patriotsoftware.com

Frequently Asked Questions

How To Set Up Accounting Books For A Small Business?

Start by choosing accounting software or a ledger. Record all transactions daily. Categorize expenses and income. Reconcile bank statements monthly. Consult with an accountant periodically.

How To Do Basic Bookkeeping For Small Business?

To do basic bookkeeping for a small business, record all transactions, categorize expenses, reconcile bank statements, and track income. Use accounting software to simplify the process. Review financial reports regularly to stay informed about your business’s financial health. Maintain organized records for tax purposes.

How To Create An Accounting System For A Small Business?

To create an accounting system for a small business, choose suitable software. Set up accounts, record transactions, and track expenses. Regularly review financial reports. Consult with an accountant for accuracy. Keep your system updated.

How Do I Make A Record Book For My Small Business?

Create a record book by organizing expenses, income, invoices, and receipts. Use accounting software for efficiency. Keep records updated regularly. Store documents securely. Maintain backups to prevent data loss.

Conclusion

Setting up accounting books for your small business is crucial. It ensures financial clarity and business growth. Follow these steps for accuracy and efficiency. Proper bookkeeping helps you make informed decisions. Stay organized, and your business will thrive. Investing time in accounting now pays off in the future.

Start today and succeed.