Yes, there are various credit card fees. These include annual fees, interest charges, late fees, and foreign transaction fees.

Credit cards offer convenience but come with several fees. Annual fees are charged for holding a card. Interest charges apply if the balance isn’t paid in full. Late fees are incurred when payments are delayed. Foreign transaction fees are charged for purchases made abroad.

Some cards may also have balance transfer fees. Understanding these fees can help you choose the right card and avoid unexpected costs. Always read the fine print and be aware of any charges. This helps you manage your finances effectively and make the most of your credit card.

Introduction To Credit Card Fees

Credit card fees can surprise many cardholders. They are charges you might not expect. Understanding these fees helps you manage your finances better. Let’s explore the common types of fees and why they matter.

Common Fee Types

Credit card companies charge different fees. Here are some of the most common ones:

- Annual Fees: Some cards charge a yearly fee. This fee is for using the card.

- Late Payment Fees: If you pay late, you get a fee. Always pay on time to avoid this.

- Balance Transfer Fees: Moving debt from one card to another can cost you. This fee is usually a percentage of the amount transferred.

- Foreign Transaction Fees: Using your card abroad might cost more. This fee is for transactions in another currency.

- Cash Advance Fees: Withdrawing cash from your credit card can be expensive. This fee is for taking out cash.

Why Fees Matter

Credit card fees can add up quickly. They can affect your budget and savings. Knowing these fees helps you make better choices.

Paying attention to fees helps you save money. Avoiding unnecessary fees keeps more cash in your pocket. Always read your credit card agreement. Understand the fees before using your card.

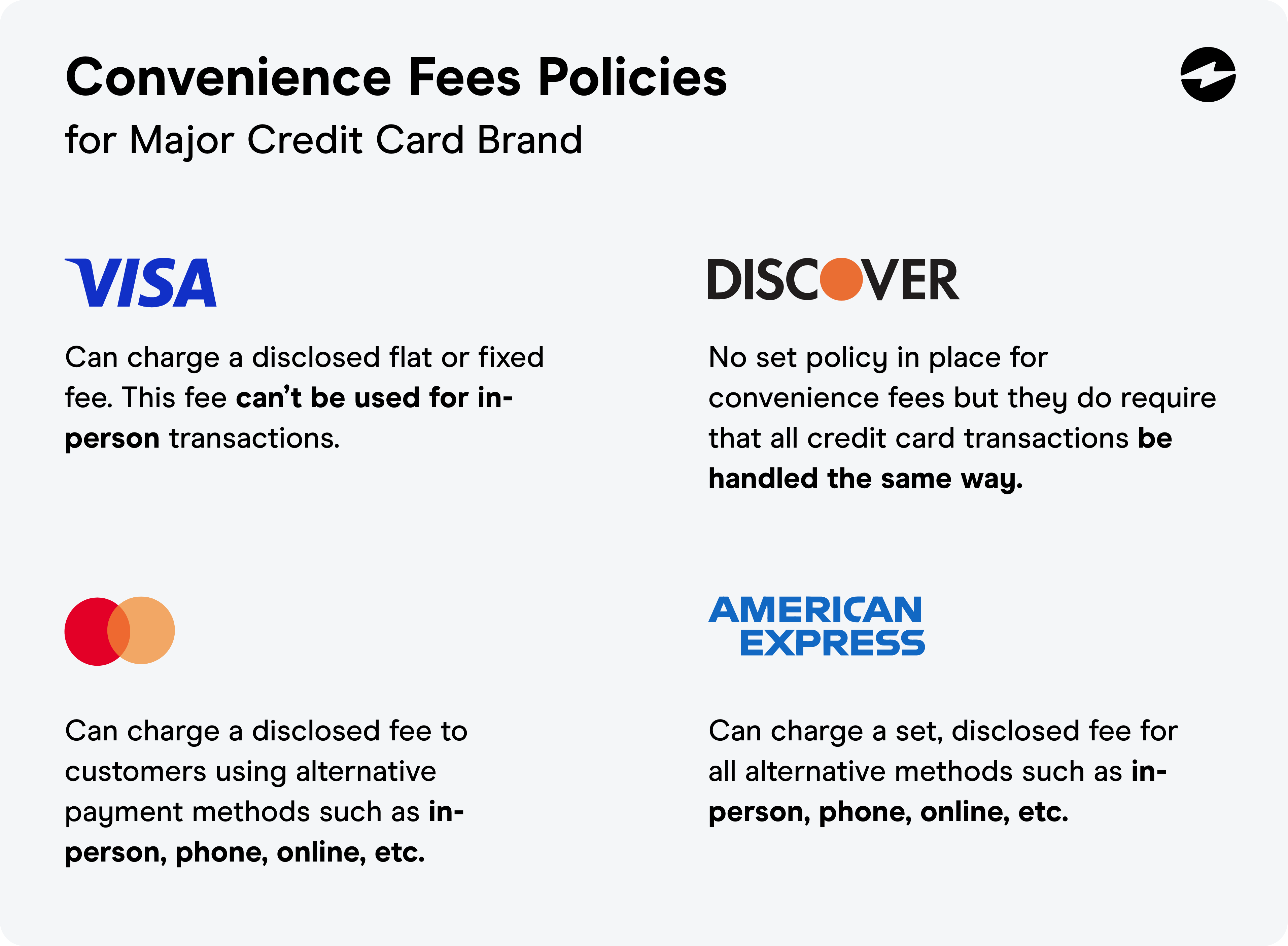

Credit: ebizcharge.com

Annual Fees

Many credit cards charge annual fees. These fees can vary widely. Some cards have no annual fees. Others can charge hundreds of dollars yearly. Understanding these fees is crucial for managing your finances.

What Are Annual Fees?

Annual fees are charges you pay every year for using a credit card. These fees cover the card’s benefits and rewards. Some cards offer valuable perks for these fees. These perks can include travel rewards, cash back, or exclusive access to events.

Here is a table to illustrate common annual fees:

| Card Type | Annual Fee |

|---|---|

| Basic Credit Card | $0 – $50 |

| Rewards Credit Card | $50 – $150 |

| Premium Credit Card | $150 – $500+ |

How To Avoid

You can avoid annual fees by choosing the right card. Many cards offer no annual fee options. Look for cards that fit your spending habits. Consider the following tips:

- Research: Compare different credit cards.

- Negotiate: Call your card issuer and ask for a waiver.

- Switch: Switch to a card with no annual fee.

Here is an ordered list to help you choose a no-annual-fee card:

- Check your spending habits.

- Compare card benefits and rewards.

- Read the terms and conditions.

- Consider your financial goals.

By following these steps, you can save money on annual fees. This helps you make the most of your credit card benefits.

Interest Charges

Interest charges on credit cards accumulate if balances aren’t paid in full each month. These fees can significantly increase overall debt. Always check your credit card’s terms to understand potential interest costs.

Interest Charges Understanding APR APR stands for Annual Percentage Rate, a key factor in credit card interest charges. APR determines how much you pay in interest on your outstanding balance. Impact on Balance APR directly impacts the total amount you owe on your credit card. Higher APR means more interest added to your balance each month. Always pay more than the minimum to reduce interest charges over time.Late Payment Fees

Credit card fees can add up quickly, especially late payment fees. These fees occur when you miss your payment due date. Let’s explore the consequences and strategies to avoid them.

Consequences Of Late Payments

Missing a payment can lead to several issues. Late fees can be as high as $40. Your credit score may drop. Interest rates on your balance can increase.

| Consequence | Details |

|---|---|

| Late Fees | Up to $40 |

| Credit Score Impact | Score may drop significantly |

| Higher Interest Rates | Interest rates on balance can rise |

Strategies To Avoid

Preventing late payments is crucial. Here are some easy ways:

- Set up automatic payments from your bank account.

- Use calendar reminders for due dates.

- Pay online for faster processing.

- Keep a buffer in your bank account.

These strategies help you stay on track. Avoiding late fees saves you money and protects your credit score.

Balance Transfer Fees

Balance transfer fees can impact your credit card costs. Understanding these fees helps you make informed decisions. Below, we explore what balance transfer fees are and when paying them might be worth it.

What Are Transfer Fees?

Balance transfer fees are charges for moving debt from one card to another. These fees are usually a percentage of the transferred amount.

| Card Provider | Transfer Fee Percentage | Minimum Fee |

|---|---|---|

| Bank A | 3% | $5 |

| Bank B | 4% | $10 |

| Bank C | 5% | $15 |

For example, transferring $1,000 with a 3% fee costs $30. Always check the fee terms before transferring a balance.

When It’s Worth It

Paying a balance transfer fee can be worth it. This is true if the interest savings outweigh the fee cost.

- Calculate the interest saved by transferring your balance.

- Compare this with the fee you will pay.

Use this simple method to decide:

- Calculate your current interest cost over time.

- Subtract the transfer fee from interest savings.

If the result is positive, transferring the balance can save you money. Use this strategy to lower your debt faster.

Credit: www.clio.com

Foreign Transaction Fees

Foreign transaction fees can surprise you during international travel. These fees apply when you use your credit card abroad. Understanding these fees can help you manage your travel budget better.

Travel Considerations

Travelers often face foreign transaction fees on credit card purchases abroad. These fees typically range from 1% to 3% of the purchase amount. They can add up quickly, especially during long trips.

Check with your bank about these fees before traveling. Knowing the charges can help you avoid overspending. It’s also a good idea to carry some local currency as a backup.

Fee-free Cards

Some credit cards offer no foreign transaction fees. These cards are ideal for frequent travelers. They help you save money on international purchases.

Here’s a table of some popular fee-free cards:

| Card Name | Annual Fee | Rewards |

|---|---|---|

| Chase Sapphire Preferred | $95 | 2x points on travel and dining |

| Capital One Venture | $95 | 2x miles on every purchase |

| Discover it Miles | $0 | 1.5x miles on every purchase |

Using a fee-free card can save you a lot of money. Always read the terms and conditions before applying. Consider your travel habits and spending patterns.

- Choose a card that fits your travel needs.

- Check for any annual fees or hidden charges.

- Look for cards with good rewards programs.

Some cards also offer travel insurance and other perks. These benefits can add extra value to your card. Always weigh the pros and cons before making a decision.

By understanding foreign transaction fees, you can travel smarter. Use the right card to maximize your savings.

Cash Advance Fees

Credit card fees can be confusing. One of the most significant fees is the cash advance fee. This fee applies when you withdraw cash using your credit card. Understanding this fee is crucial to managing your finances.

High Costs Of Cash Advances

Cash advances come with high costs. The fee usually ranges from 2% to 5% of the amount withdrawn. For example, if you withdraw $500, the fee could be $25.

Additionally, interest rates for cash advances are higher. Unlike regular purchases, interest starts accruing immediately. There’s no grace period. This means you start paying interest from day one.

A table below shows a comparison:

| Transaction Type | Fee Percentage | Interest Accrual |

|---|---|---|

| Regular Purchase | 0% | After Grace Period |

| Cash Advance | 2% – 5% | Immediately |

Alternatives To Cash Advances

Cash advances should be a last resort. There are better alternatives. Here are some options:

- Personal Loan: Lower interest rates than cash advances.

- Borrow from Friends or Family: No fees and interest.

- Use Savings: Avoid fees and high interest rates.

Choosing an alternative saves you money. It also helps in better financial planning.

Penalty Fees

Credit card penalty fees are charges for missed or late payments. These fees can add up quickly. Understanding these penalties can help you avoid extra costs.

Common Penalties

Here are some common credit card penalty fees:

- Late Payment Fees: Charged if you miss the payment date.

- Over-the-Limit Fees: Applied if you exceed your credit limit.

- Returned Payment Fees: Incurred if your payment is returned.

How To Avoid Penalties

Follow these tips to avoid penalty fees:

- Pay on Time: Always pay your bill before the due date.

- Set Up Alerts: Enable payment reminders on your phone.

- Monitor Your Spending: Regularly check your credit card balance.

- Use Auto-Pay: Enroll in automatic payments to never miss a due date.

By following these steps, you can avoid extra charges. This will help you save money and maintain a good credit score.

Tips To Minimize Fees

Credit card fees can quickly add up and affect your budget. Fortunately, there are strategies to minimize these fees. By choosing the right card and adopting smart payment habits, you can save money. Let’s explore some effective tips to reduce credit card fees.

Choosing The Right Card

Selecting the right credit card is essential. Different cards come with various fees. Compare cards and look for ones with low or no annual fees.

- Annual Fees: Some cards charge annual fees, while others do not. Choose a card without an annual fee if possible.

- Foreign Transaction Fees: If you travel internationally, pick a card without foreign transaction fees.

- Interest Rates: Compare interest rates. Lower rates mean less interest if you carry a balance.

Smart Payment Habits

Adopting smart payment habits can help avoid fees. Paying your bill on time is crucial.

- Pay on Time: Late payments result in late fees. Set reminders to pay on time.

- Pay in Full: Paying your balance in full each month avoids interest charges.

- Monitor Spending: Keep track of your spending to avoid going over your limit.

By choosing the right card and maintaining smart payment habits, you can minimize credit card fees effectively.

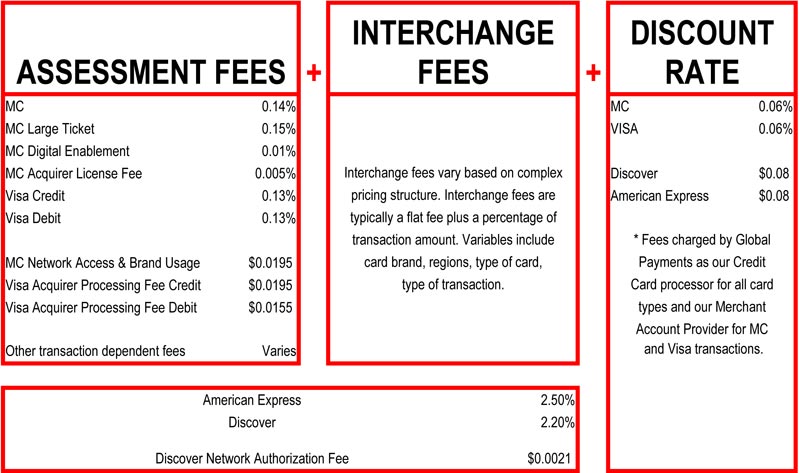

Credit: www.fiscal.ttuhsc.edu

Frequently Asked Questions

Do You Pay A Fee For A Credit Card?

Yes, many credit cards have annual fees. Some offer no-fee options. Check terms before applying.

Are There Any Charges For Using A Credit Card?

There may be charges for using a credit card, such as annual fees or interest.

In What States Is It Illegal To Charge Credit Card Fees?

It is illegal to charge credit card fees in Connecticut, Massachusetts, and Puerto Rico. Other states have specific regulations. Always check local laws.

How Can You Avoid Credit Card Fees?

To avoid credit card fees, pay your balance in full each month. Set up automatic payments. Use cards with no annual fees. Avoid cash advances. Monitor your statements regularly.

Conclusion

Understanding credit card fees helps manage finances better. Always read terms and conditions carefully. This ensures you’re aware of all potential costs. By staying informed, you can avoid unnecessary charges. Make smart choices to maximize your credit card benefits. Keep these tips in mind for a financially healthy future.