Yes, there are third-party transaction fees. These fees vary depending on the payment processor.

Third-party transaction fees are charges imposed by payment processors for handling transactions. Businesses often rely on these processors to facilitate secure and efficient payments. Common examples include PayPal, Stripe, and Square. Fees can be a flat rate or a percentage of the transaction amount.

Understanding these costs is crucial for budgeting and pricing strategies. High fees can significantly impact profit margins. Choosing the right payment processor can help minimize costs and improve overall business efficiency. Always review the fee structure and terms of service before committing to a payment processor to avoid unexpected expenses.

Introduction To Transaction Fees

Understanding the different types of transaction fees is crucial. These fees can affect your budget and overall costs. Below, we explore two main types: processing fees and service charges.

Processing Fees

Processing fees are charges for handling payments. These fees are usually small but can add up over time. They often depend on the payment method used.

| Payment Method | Typical Fee |

|---|---|

| Credit Card | 2.5% – 3.5% |

| Debit Card | 0.5% – 1.0% |

| PayPal | 2.9% + $0.30 |

Processing fees can vary based on the payment processor. Always check the rates before choosing a processor. This helps in making informed decisions.

Service Charges

Service charges are additional fees for using a service. These can include account maintenance and customer support fees. Service charges are often fixed amounts.

- Monthly maintenance fees

- Customer support fees

- Setup fees

Service charges ensure the smooth operation of the service. They cover costs like support and maintenance. These fees can vary widely among different providers.

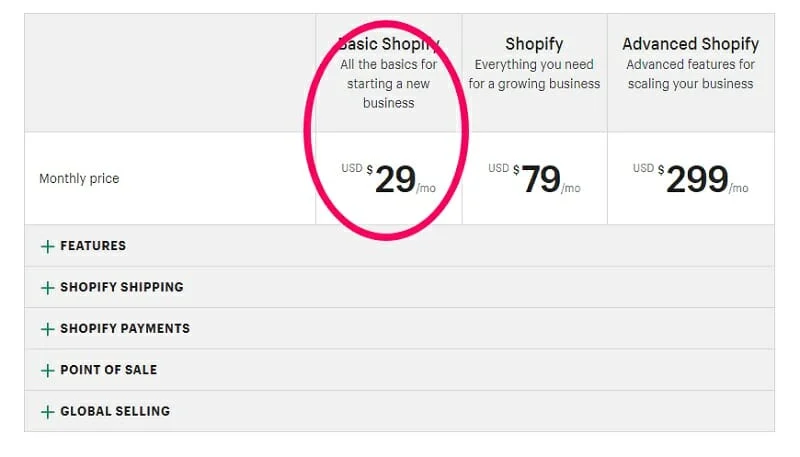

Credit: ecommerce.folio3.com

Types Of Transaction Fees

Third-party involvement is common in online transactions. Companies use third-party providers for various services. These services include payment processing, shipping, and customer support. Involvement from third parties often means extra fees. Understanding these fees is crucial for budgeting and planning.

Who Are Third-party Providers?

Third-party providers offer services to businesses. They handle tasks that businesses might not manage internally. Common third-party providers include:

- Payment Processors: Companies like PayPal, Stripe, and Square.

- Shipping Services: Firms such as FedEx, UPS, and DHL.

- Customer Support: Providers like Zendesk and Freshdesk.

These providers charge fees for their services. These fees can add up and impact your bottom line.

Common Third-party Fees

Third-party fees vary based on the service. Here are some common fees you might encounter:

| Service Type | Common Fees |

|---|---|

| Payment Processing | Transaction fees, monthly fees, and chargeback fees. |

| Shipping | Shipping rates, handling fees, and insurance costs. |

| Customer Support | Subscription fees and per-ticket fees. |

Understanding these fees can help you manage costs effectively. Always read the terms and conditions before choosing a third-party provider.

Third-party Involvement

When you make online transactions, there can be hidden costs. These hidden costs can surprise you. Let’s break down these hidden costs and understand them better.

Unexpected Fees

Many services charge unexpected fees. These fees are not always clear.

- Processing Fees: Some services charge for processing payments. This fee can be a percentage of the transaction.

- Currency Conversion Fees: When you pay in a different currency, you may face extra charges.

- Service Fees: Platforms may charge a service fee for using their services.

Understanding these fees helps you avoid surprises. Always check for hidden fees before making a payment.

Terms And Conditions

The terms and conditions often hide extra costs. Most users skip reading them.

Here are common places where fees are hidden:

- Subscription Services: Look for automatic renewals and extra charges.

- Shipping and Handling: Some services add high shipping fees at checkout.

- Cancellation Fees: Canceling a service may result in unexpected charges.

Reading the terms and conditions can save you money. Always look for any hidden fees mentioned in the fine print.

Credit: www.researchgate.net

Hidden Costs Explained

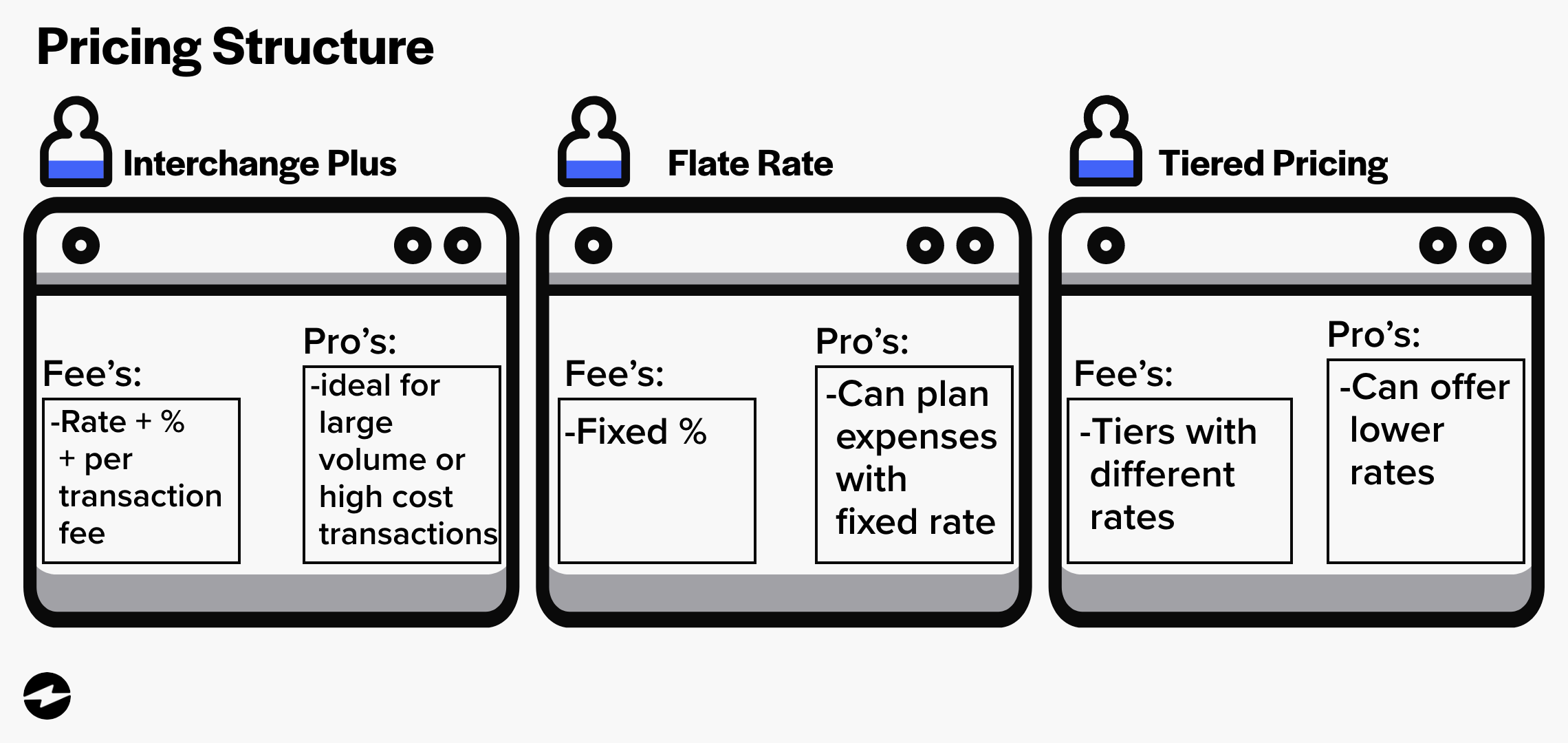

Understanding third-party transaction fees is crucial for businesses. These fees can affect your profit margins and overall budget. Knowing the cost implications helps in making informed decisions.

Cost Implications

Third-party transaction fees can vary widely. Some providers charge a flat fee, while others take a percentage of the transaction. These costs can add up quickly and impact your bottom line.

Here’s a simple breakdown:

| Provider | Fee Type | Cost |

|---|---|---|

| Provider A | Flat Fee | $0.30 per transaction |

| Provider B | Percentage | 2.9% + $0.25 per transaction |

These fees may seem small but can add up over time. This can especially impact small businesses with tight profit margins.

Budget Considerations

Businesses should account for these fees in their budgets. It’s essential to estimate the total monthly cost of transaction fees. Knowing this helps in planning and ensures there are no surprises at the end of the month.

Consider these points:

- Calculate the average transaction fee per month.

- Include this in your monthly expenses.

- Look for ways to minimize these fees, if possible.

Using this information can help you budget more effectively and ensure financial stability.

Impact On Businesses

Third-party transaction fees can add up quickly. Finding ways to reduce these fees can save your business money. Below are some effective strategies to help you minimize these costs.

Negotiation Tips

Negotiate with your payment processor. Many are open to discussions. Highlight your transaction volume to get better rates. Ask if they offer volume discounts. Consider switching if they won’t budge. Always compare multiple offers before deciding.

Alternative Payment Methods

Offer alternative payment methods to your customers. Some options have lower fees. Here are a few to consider:

| Payment Method | Average Fee |

|---|---|

| Bank Transfers | 1% |

| Cryptocurrencies | 0.5% – 1% |

| e-Wallets | 1% – 2% |

Encourage customers to use these cheaper options. Offer incentives for using lower-fee methods. Small discounts can motivate them to switch. Use clear communication to inform them about the benefits.

By following these strategies, you can significantly reduce third-party transaction fees. This will help you keep more of your earnings and improve your bottom line.

Credit: ebizcharge.com

Impact On Consumers

The future of third-party transaction fees is evolving. As technology advances and regulations change, the landscape shifts. Here’s a look at the future trends in this space.

Technology’s Role

Technology is playing a big part in reducing transaction fees. Many new payment systems use blockchain technology. Blockchain can lower costs by cutting out middlemen. This means fewer fees for users.

Mobile payment apps are also growing. These apps make transactions faster and cheaper. They often have lower fees compared to traditional banks. As more people use mobile apps, fees will drop even further.

Regulatory Changes

Governments are changing laws to protect consumers. New regulations aim to reduce hidden fees. Transparent fee structures are becoming the norm. This helps users understand what they are paying for.

Some countries are capping transaction fees. This means there is a limit to how much companies can charge. These caps benefit consumers by keeping costs low.

Key Regulatory Changes:

- Cap on transaction fees

- Transparent fee structures

- Consumer protection laws

| Country | New Regulation |

|---|---|

| USA | Cap on credit card fees |

| EU | Transparent fee disclosure |

| India | Consumer protection laws |

As these trends continue, third-party transaction fees will likely decrease. Keeping an eye on technology and regulations will help you stay informed.

Frequently Asked Questions

What Is A Third Party Transaction Fee?

A third party transaction fee is a charge by an intermediary for processing payments. These fees cover costs like security and convenience. They vary by service provider and transaction type.

What Is Considered A Third Party Transaction?

A third-party transaction involves a buyer, a seller, and an intermediary. The intermediary facilitates the transaction between the two parties.

Is There Such Thing As A Transaction Fee?

Yes, transaction fees exist. They are charges applied to process payments, usually by banks or payment processors.

Do Customers Pay Transaction Fees?

Yes, customers pay transaction fees. These fees vary based on the payment method used and the service provider.

Conclusion

Understanding third-party transaction fees is crucial for managing costs. These fees can impact your overall budget. Always review terms before committing. By staying informed, you can make smarter financial decisions. Keep an eye on potential hidden charges to avoid surprises.

Smart planning can help you save money in the long run.