To make more money for your family, consider pursuing higher-paying job opportunities or starting a side hustle. Budgeting and financial planning can also help increase savings.

Increasing your family’s income can significantly enhance your quality of life and provide financial security. Exploring higher-paying job opportunities or starting a side hustle are effective ways to generate extra income. Many side hustles, such as freelance work, online tutoring, or selling handmade goods, can be managed alongside a full-time job.

Effective budgeting and financial planning play a crucial role in maximizing your earnings and savings. By creating a budget, you can identify areas where you can cut expenses and allocate more money towards your financial goals. Taking these steps can help you achieve a more stable and prosperous future for your family.

Credit: www.instagram.com

Freelancing

Freelancing is a fantastic way to make extra money for your family. It offers flexibility and the chance to use your skills. You can work from home and choose your projects.

Choosing The Right Skills

Picking the right skills is key to freelancing success. Identify what you are good at and enjoy doing. Here are some popular freelance skills:

- Writing: Blog posts, articles, and copywriting.

- Graphic Design: Logos, brochures, and social media graphics.

- Web Development: Building and maintaining websites.

- Digital Marketing: SEO, social media, and email marketing.

Choose skills that are in demand and align with your strengths. This will make it easier to find clients and deliver quality work.

Finding Clients

Getting clients is crucial for a successful freelancing career. Here are some ways to find clients:

- Freelance Platforms: Sign up on websites like Upwork, Fiverr, and Freelancer.

- Networking: Tell friends, family, and colleagues about your services.

- Social Media: Use LinkedIn, Facebook, and Twitter to promote your skills.

- Cold Emailing: Reach out to potential clients with a strong pitch.

Building a strong portfolio also helps attract clients. Showcase your best work to demonstrate your abilities.

Freelancing offers a flexible way to earn more money for your family. By choosing the right skills and finding clients, you can build a successful freelance career.

Remote Work

The need to make more money for your family is crucial. Remote work offers a flexible way to increase income without leaving home. You can balance family duties while earning a stable income.

Popular Remote Jobs

Many remote jobs are available today. Here are some popular options:

- Freelance Writing: Write articles, blogs, or web content for clients.

- Virtual Assistant: Help businesses with administrative tasks from home.

- Customer Service: Assist customers via phone, chat, or email.

- Online Tutoring: Teach subjects to students through video calls.

- Data Entry: Input data into systems from home.

These jobs often require basic skills and a reliable internet connection.

Balancing Home And Work

Balancing home and work life can be a challenge. Here are some tips:

- Create a Schedule: Set specific work hours each day.

- Designate a Workspace: Have a dedicated area for work.

- Take Breaks: Short breaks can help you stay focused.

- Set Boundaries: Let family know your work hours to avoid interruptions.

- Stay Organized: Use tools like calendars or to-do lists.

Balancing these aspects ensures you remain productive and present for your family.

Side Hustles

When you need to make more money for your family, side hustles can be a great way to boost your income. Whether you’re looking to pay off debt, save for a big expense, or just increase your monthly cash flow, side gigs offer flexibility and extra earnings.

Best Side Gigs

If you’re considering a side hustle, here are some of the best options:

- Freelance writing

- Virtual assistant services

- Online tutoring

- Graphic design

- Photography

These side gigs can be done part-time, allowing you to earn extra money without disrupting your current job or family responsibilities.

Time Management Tips

When juggling a side hustle with your main job and family duties, efficient time management is key. Here are some tips to help you balance it all:

- Create a schedule and stick to it

- Prioritize tasks based on urgency

- Delegate responsibilities when possible

- Use time-blocking techniques

By implementing these time management strategies, you can make the most of your side hustle while still maintaining a healthy work-life balance.

Investing

Investing is a powerful way to grow your family’s wealth. By putting money into various opportunities, you can generate extra income. Let’s explore some popular investment options.

Stock Market Basics

The stock market is a place where you can buy and sell shares of companies. When you own a share, you own a small part of that company. Stocks can increase in value, allowing you to make money. Start by researching companies and their performance. Diversify your investments to minimize risks.

- Buy shares of different companies

- Track the stock market regularly

- Consider using a financial advisor

Use online platforms like Robinhood or ETRADE to begin investing in stocks. Remember, the stock market can be volatile. Always invest wisely and stay informed.

Real Estate Opportunities

Real estate is another excellent investment option. You can buy properties to rent or sell later for profit. Start by identifying good locations. Research property values and market trends.

| Type | Pros | Cons |

|---|---|---|

| Rental Properties | Steady income | Maintenance costs |

| Flipping Houses | Quick profit | High risk |

Real estate requires a significant investment. Ensure you have enough funds for initial costs and maintenance. Real estate can provide stable income and long-term growth.

Consider investing in REITs (Real Estate Investment Trusts) for a more hands-off approach. REITs allow you to invest in real estate without owning physical properties.

Investing wisely can help you make more money for your family. Always research and seek professional advice if needed.

Online Businesses

Starting an online business can help you make more money for your family. It offers flexibility, low startup costs, and the potential for growth. Let’s explore some ideas and strategies to get you started.

E-commerce Ideas

- Sell Handmade Products: Create and sell crafts or art.

- Drop Shipping: Partner with suppliers who ship products directly to customers.

- Print on Demand: Sell custom T-shirts, mugs, or posters.

- Digital Products: Sell e-books, courses, or software.

Marketing Strategies

| Strategy | Description |

|---|---|

| SEO | Optimize your website to rank higher in search engines. |

| Social Media | Promote your products on platforms like Facebook and Instagram. |

| Email Marketing | Send newsletters and offers to your subscribers. |

| Content Marketing | Create valuable content to attract and engage customers. |

Use these e-commerce ideas and marketing strategies to grow your online business. The right approach can help you achieve financial freedom and support your family.

Credit: quotefancy.com

Passive Income

Want to make more money for your family? Passive income can help. It’s a way to earn money without active work. You can create digital products or invest in rental properties. Let’s explore these options.

Creating Digital Products

Making digital products is a great way to earn passive income. You create something once and sell it many times.

Here are some ideas for digital products:

- eBooks: Write about a topic you know well.

- Online Courses: Teach a skill you are good at.

- Printables: Design planners, calendars, or worksheets.

- Stock Photos: Sell your photos online.

Once your product is ready, you can sell it on websites like Amazon, Etsy, or your own site. Digital products can bring in money while you sleep.

Rental Properties

Investing in rental properties is another way to earn passive income. You buy a property and rent it out. This can provide a steady stream of money each month.

Consider these tips:

- Location: Choose a good area with high demand.

- Maintenance: Keep the property in good shape.

- Tenants: Find reliable people to rent your property.

- Management: Hire a property manager if needed.

Rental properties can be a long-term investment. They can provide income for years to come.

Both digital products and rental properties can help you make more money for your family. Start today and build a better future.

Education And Training

Education and training are key to increasing your income. They open doors to better-paying jobs. Investing in learning can benefit your family greatly. Here are some ways to get started.

In-demand Courses

Many courses can boost your career. Here are some popular options:

- Data Science: High demand and high pay.

- Digital Marketing: Helps businesses grow online.

- Web Development: Needed in almost every industry.

- Healthcare: Always in need of skilled workers.

These courses often lead to well-paying jobs. You can take them online or in person. Some are free or low-cost.

Certifications Worth Getting

Certifications can help you stand out. They show that you have special skills. Here are some valuable certifications:

| Certification | Field | Benefits |

|---|---|---|

| Project Management Professional (PMP) | Project Management | Higher pay and job security. |

| Certified Information Systems Security Professional (CISSP) | Cybersecurity | High demand and high salaries. |

| Certified Public Accountant (CPA) | Accounting | Trusted and well-paid positions. |

These certifications require some studying and exams. But they can lead to better jobs and more money for your family.

Networking

Networking is a powerful tool to increase income for your family. Connecting with the right people can open doors to new opportunities. It helps you find better jobs, freelance gigs, and business deals.

Building Professional Relationships

Professional relationships are key to growing your network. Attend industry events and seminars to meet people in your field. Join local business groups and online forums to expand your circle. Always carry business cards and follow up with new contacts. Building trust and rapport is crucial.

- Attend industry events

- Join local business groups

- Participate in online forums

Leveraging Social Media

Social media platforms are effective for networking. Use LinkedIn to connect with professionals in your industry. Share valuable content to showcase your expertise. Twitter and Facebook groups can also help you find opportunities.

| Platform | Purpose |

|---|---|

| Professional networking | |

| Industry news and connections | |

| Facebook Groups | Community engagement and opportunities |

Be active and engage with others’ posts. Comment, like, and share content to build visibility. Your social media presence can lead to job offers and collaborations.

Financial Planning

Financial planning is crucial for ensuring your family’s financial security. It helps manage expenses, save for the future, and build a stable financial foundation. Let’s dive into some effective strategies to make the most out of your earnings.

Budgeting Tips

Creating a budget is the first step towards financial stability. It allows you to track your income and expenses, ensuring you live within your means. Here are some simple tips:

- List all sources of income: This includes salary, bonuses, and side gigs.

- Track your expenses: Note down daily spending and categorize them.

- Set financial goals: Short-term and long-term goals guide your budgeting.

- Use budgeting tools: Apps like Mint or YNAB can simplify this process.

- Review and adjust: Regularly check your budget and make necessary changes.

Saving For The Future

Saving money ensures a secure future for your family. Building an emergency fund and planning for long-term goals are vital. Here are some strategies to help you save effectively:

- Open a savings account: Choose one with a good interest rate.

- Set automatic transfers: Automate monthly savings to ensure consistency.

- Cut unnecessary expenses: Identify and reduce non-essential spending.

- Invest wisely: Consider stocks, bonds, or mutual funds for long-term growth.

- Plan for retirement: Contribute to retirement accounts like 401(k) or IRA.

Here is a simple table to visualize how much you can save monthly:

| Income Bracket | Monthly Savings Goal |

|---|---|

| $2,000 – $3,000 | $200 |

| $3,000 – $4,000 | $300 |

| $4,000 – $5,000 | $400 |

Financial planning is a journey. Start today to secure a better future for your family.

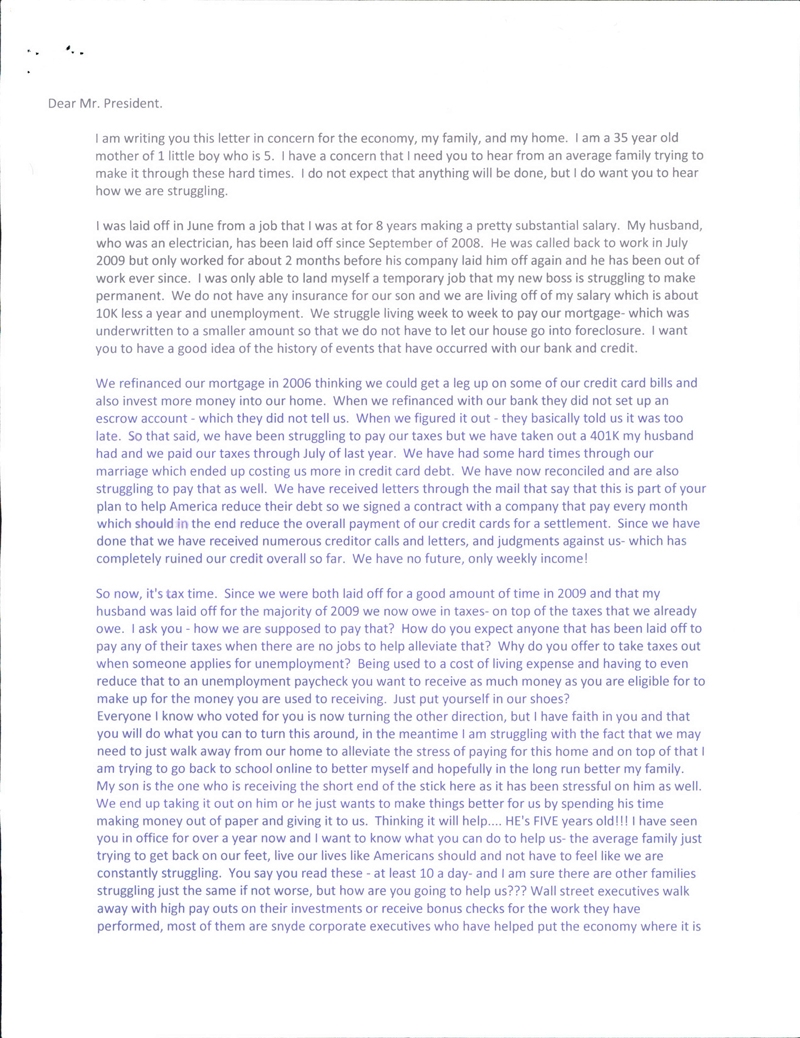

Credit: obamawhitehouse.archives.gov

Frequently Asked Questions

How To Earn More Money For Your Family?

Start a side hustle or freelance work. Learn new skills to advance in your career. Budget wisely and save regularly. Invest in stocks or real estate. Explore remote job opportunities.

How To Make Extra $1000 A Month?

Start a side gig like freelancing, tutoring, or driving for rideshare services. Sell items online, rent out a room, or start a small business. Use skills like writing, graphic design, or coding to find clients. Save money by budgeting and cutting unnecessary expenses.

How To Make $1000 In 24 Hours?

To make $1000 in 24 hours, consider selling high-ticket items, offering a premium service, or hosting a flash sale. Utilize social media, email marketing, and partnerships to reach a wider audience quickly. Optimize your pricing strategy and provide exceptional customer service to boost sales.

What Is A Good Salary To Start A Family?

A good starting salary for a family varies by location. Generally, $50,000 to $75,000 annually is considered adequate. Adjust for local living costs.

How Can I Increase My Income Quickly?

To increase income fast, consider freelancing, side gigs, or asking for a raise at work.

What Are Some Effective Money-making Strategies?

Investing in stocks, starting a small business, and real estate can be profitable strategies.

Is Passive Income A Reliable Source Of Money?

Yes, passive income from investments, rental properties, or online businesses can provide stable earnings.

How Can I Save Money For My Family’s Future?

Create a budget, cut unnecessary expenses, and automate savings to secure your family’s future.

What Are The Best Ways To Budget Effectively?

Track expenses, prioritize needs over wants, and use budgeting apps for better financial planning.

Can I Earn Extra Money From Home?

Yes, you can make money from home through online jobs, virtual services, or selling products.

Conclusion

Finding ways to make more money for your family is essential. Explore side gigs, budget effectively, and invest wisely. Take small steps toward financial stability. Every effort brings you closer to your goals. Prioritize your family’s needs and stay committed.

Your financial future can be brighter with persistence and smart choices.