Yes, accounting software is essential for small businesses. It simplifies financial management and ensures accuracy.

Small business owners face numerous challenges, and managing finances is a critical one. Accounting software helps streamline financial tasks like invoicing, tracking expenses, and preparing tax documents. This automation saves time, reduces errors, and provides real-time financial insights. With easy-to-use interfaces, even those without accounting expertise can maintain accurate records.

Good software also supports compliance with tax regulations, avoiding costly mistakes. Investing in accounting software ensures efficient, accurate financial management, allowing business owners to focus on growth and customer satisfaction.

Introduction To Small Business Accounting

Small business owners often wear many hats. Managing finances is one of the most important tasks. Understanding the basics of accounting can help keep your business healthy.

Accounting involves tracking income, expenses, and ensuring accurate financial records. It helps in making informed business decisions. Proper accounting ensures compliance with tax laws and regulations.

The Role Of Financial Management

Financial management is crucial for small businesses. It involves budgeting, forecasting, and planning. These activities help in tracking your financial health.

Effective financial management allows businesses to allocate resources efficiently. This leads to better investment decisions and improved profitability.

A well-maintained financial system can also help in securing loans. Lenders often require detailed financial records before approving funding.

Challenges Of Manual Accounting

Manual accounting can be time-consuming and error-prone. Small business owners may struggle to keep accurate records.

Mistakes in manual accounting can lead to financial discrepancies. This may result in incorrect financial statements and tax filings.

Manual methods can also be inefficient. They require a lot of paperwork and physical storage space. This can be cumbersome and prone to data loss.

The following table highlights some common challenges of manual accounting:

| Challenge | Description |

|---|---|

| Time-Consuming | Manual entry takes a lot of time. |

| Error-Prone | Human errors can occur easily. |

| Data Loss | Physical records can be lost or damaged. |

Switching to accounting software can solve many of these issues. It can streamline your accounting processes and improve accuracy.

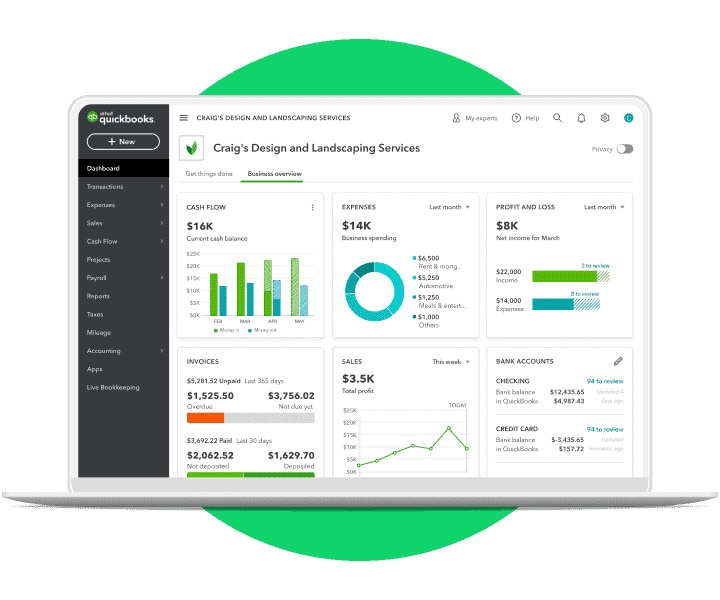

Credit: quickbooks.intuit.com

Evaluating Business Needs For Accounting Software

Determining if you need accounting software involves assessing your business needs. This software can streamline your financial tasks and save time. Understanding your business scale and recognizing signs of needed upgrades are key.

Assessing The Scale Of Operations

Consider the size of your business operations. A small business with few transactions may not need complex software. However, larger businesses with many transactions benefit from advanced features.

Evaluate the number of employees you have. More employees mean more payroll tasks. Accounting software can automate these tasks efficiently.

Think about your inventory management. If you have a large inventory, software can track stock levels and reduce errors.

| Business Size | Accounting Needs |

|---|---|

| Small | Basic software for invoices and expenses |

| Medium | Software with payroll and inventory management |

| Large | Advanced software with comprehensive features |

Recognizing The Signs You Need An Upgrade

Look for signs that your current system is failing. Increased errors in financial records indicate a need for better software. Manual processes that take too much time also suggest an upgrade is needed.

Frequent delays in financial reporting can harm your business. Software can provide real-time data and insights.

If your business grows, your accounting needs change. Upgrading your software ensures you keep up with the growth.

- Frequent errors in financial records

- Time-consuming manual processes

- Delays in financial reporting

- Business growth outpacing current software

Upgrading your software can streamline operations. It helps you manage finances more effectively.

Key Benefits Of Accounting Software

Small business owners often juggle multiple tasks daily. One crucial aspect is managing finances efficiently. Accounting software offers significant advantages. It simplifies tasks, saves time, and enhances accuracy. Let’s explore the key benefits of using accounting software.

Streamlining Financial Transactions

Accounting software streamlines financial transactions effortlessly. It automates data entry, reducing manual errors. With a few clicks, you can record expenses and revenue. This ensures your books are always up-to-date.

Integration with bank accounts allows automatic transaction imports. This feature saves time and minimizes errors. You can categorize expenses and income accurately. Managing invoices and bills becomes straightforward. Generate and send invoices quickly. Track pending payments easily.

Accurate And Timely Reports

Accurate and timely reports are crucial for decision-making. Accounting software generates precise financial statements. Get real-time insights into your business’s financial health.

Here are some key reports you can generate:

- Profit and Loss Statement: Understand your business’s profitability.

- Balance Sheet: Get a snapshot of your assets and liabilities.

- Cash Flow Statement: Track your cash inflows and outflows.

These reports help in planning and forecasting. They provide a clear picture of your financial status. This aids in making informed business decisions.

| Report Type | Purpose |

|---|---|

| Profit and Loss Statement | Shows revenue, expenses, and profit |

| Balance Sheet | Displays assets and liabilities |

| Cash Flow Statement | Tracks cash movements |

Using accounting software ensures your reports are always accurate. It eliminates the risk of human error. Real-time data access helps you stay updated.

Cost-saving Aspects Of Automated Accounting

Automated accounting can save small businesses significant costs. It streamlines processes, reduces errors, and improves efficiency. This section explores the cost-saving aspects of automated accounting, focusing on two key areas.

Reduction In Human Errors

Manual accounting is prone to errors. These mistakes can lead to financial losses. Automated accounting software reduces human errors. It ensures accurate financial data.

- Automated calculations eliminate manual mistakes.

- Real-time updates keep records current.

- Prevents duplicate entries and data inconsistencies.

Errors can be costly to fix. Automation helps avoid these costs. It also saves valuable time.

Long-term Financial Efficiency

Investing in accounting software has long-term benefits. It reduces the need for extensive manual work. This saves money on labor costs.

Consider the following table for a clearer picture:

| Manual Accounting | Automated Accounting |

|---|---|

| High labor costs | Lower labor costs |

| Time-consuming processes | Efficient processes |

| Prone to errors | Accurate data |

Automated systems also provide valuable insights. They help in making informed financial decisions.

- Track expenses efficiently.

- Monitor cash flow in real-time.

- Generate detailed financial reports.

These features contribute to overall financial efficiency in the long run.

Improving Cash Flow Management

Managing cash flow is crucial for small business success. Accounting software can greatly improve this process. It provides tools to monitor, forecast, and plan your finances. This ensures your business stays financially healthy.

Real-time Monitoring Tools

Accounting software offers real-time monitoring tools. These tools track income and expenses instantly. You can see how money moves in and out. This helps you make quick and informed decisions.

With real-time monitoring, you avoid overspending. You can catch financial issues early. This keeps your cash flow steady and predictable.

Forecasting And Planning

Accurate forecasting is key to good cash flow management. Accounting software helps you forecast and plan your finances. It uses past data to predict future cash flow.

You can create budgets and set financial goals. This ensures you are prepared for future expenses. It also helps you save for growth opportunities.

Here are some forecasting features:

- Income and expense predictions

- Budget planning

- Financial goal setting

These features ensure your business remains financially stable. They help you plan for both short-term and long-term needs.

| Feature | Benefit |

|---|---|

| Real-Time Monitoring | Quick decision making |

| Forecasting | Prepare for future expenses |

| Budget Planning | Set and achieve financial goals |

Using accounting software makes cash flow management easier. It keeps your business on track and financially healthy.

Enhancing Compliance And Security

Enhancing compliance and security is essential for small businesses. Accounting software offers tools to meet these needs. It helps you stay compliant and protect your data.

Keeping Up With Regulatory Changes

Regulations change frequently. Accounting software updates automatically. This ensures your business stays compliant. You don’t need to track changes manually. The software does it for you.

| Feature | Benefit |

|---|---|

| Automatic Updates | Stay compliant without manual effort |

| Tax Calculations | Accurate tax filings |

| Audit Trails | Easy to track financial transactions |

These features help you avoid penalties and fines. Staying compliant saves you money and stress.

Protecting Sensitive Financial Data

Small businesses handle sensitive data. Accounting software protects this data. It uses encryption and access controls.

- Encryption: Keeps data safe during storage and transfer.

- Access Controls: Limits who can see and change information.

- Regular Backups: Ensures data is not lost.

These measures prevent data breaches. They protect your business and customers. Data security is crucial for trust and reputation.

Scalability And Integration Capabilities

Choosing the right accounting software for your small business can be challenging. One crucial aspect to consider is the scalability and integration capabilities of the software. These features ensure the software grows with your business and syncs with other essential tools.

Growing With Your Business

As your business expands, so do your accounting needs. Scalable accounting software can handle increased transactions and data. It supports more users without a drop in performance. This ensures your business operates smoothly even during growth spurts.

Here are some benefits of scalable accounting software:

- Handles more invoices and transactions.

- Supports additional users and roles.

- Manages larger volumes of data.

- Offers advanced reporting features.

Syncing With Other Business Tools

Integration capabilities are another vital feature of accounting software. Syncing with other business tools improves efficiency and reduces errors.

Common tools to integrate with include:

| Tool | Benefit |

|---|---|

| CRM Systems | Automates customer billing and invoicing. |

| Payroll Software | Ensures accurate employee payments. |

| Inventory Management | Keeps stock levels up-to-date. |

| Bank Accounts | Facilitates easy bank reconciliations. |

Integrating these tools with your accounting software streamlines operations. It also provides a unified view of your business finances.

For small businesses, these integration capabilities are essential. They save time and reduce manual errors, making your processes more efficient.

Credit: quickbooks.intuit.com

Choosing The Right Accounting Software

Choosing the right accounting software is crucial for your small business. Good software helps you manage finances easily and accurately. It saves time and reduces errors, leading to better decision-making. Here are some tips to help you choose the best accounting software.

Important Features To Consider

- Ease of Use: The software should be easy to use. You don’t need advanced accounting skills.

- Scalability: Choose software that grows with your business. It should handle more transactions as you expand.

- Cost: Consider your budget. Some software may offer free trials or affordable plans.

- Integration: The software should integrate with other tools you use. This saves time and reduces manual work.

- Customer Support: Good customer support is essential. Ensure help is available when you need it.

- Security: Your financial data must be secure. Look for software with strong security features.

Comparing Top Accounting Software Options

Here are some top accounting software options for small businesses:

| Software | Key Features | Price |

|---|---|---|

| QuickBooks |

|

Starts at $25/month |

| FreshBooks |

|

Starts at $15/month |

| Xero |

|

Starts at $11/month |

Choose software that fits your needs and budget. Consider the features and support each option offers. The right choice will help your business thrive.

Implementation And Training

Implementing accounting software in your small business can seem daunting. Proper implementation and training ensure you get the most out of your investment. This section focuses on setting up for success and educating your team. Both are crucial for smooth operations.

Setting Up For Success

Setting up accounting software correctly is the first step. Follow these steps for a successful setup:

- Choose the Right Software: Select software that meets your business needs.

- Install the Software: Ensure installation on all necessary devices.

- Customize Settings: Tailor the software settings to fit your business processes.

- Input Initial Data: Enter your existing financial data accurately.

A well-planned setup minimizes future issues. It ensures accurate financial tracking from the start.

Educating Your Team

Your team must understand how to use the new software. Training ensures everyone is on the same page.

Consider these training methods:

- Online Tutorials: Many software providers offer free tutorials.

- In-Person Training: Schedule sessions for hands-on learning.

- Documentation: Provide user manuals for reference.

- Support Resources: Ensure access to customer support for questions.

Training helps your team use the software effectively. This leads to better financial management and fewer errors.

| Training Method | Benefits |

|---|---|

| Online Tutorials | Flexible and self-paced learning |

| In-Person Training | Hands-on experience and instant feedback |

| Documentation | Quick reference and detailed instructions |

| Support Resources | Access to expert help when needed |

Well-trained employees are confident and efficient. They make fewer mistakes and save time.

Conclusion: Making The Decision

Deciding whether to invest in accounting software for your small business can be challenging. It involves evaluating various factors to ensure it aligns with your business needs. Let’s break down the decision-making process in a structured manner.

Weighing The Pros And Cons

| Pros | Cons |

|---|---|

| Saves time on manual calculations. | Can be expensive for small businesses. |

| Reduces errors in financial records. | May require training to use effectively. |

| Offers real-time financial insights. | Some software has limited customization. |

| Automates repetitive tasks. | Not all software integrates well with other tools. |

Taking The Next Steps

- Identify your business needs and budget.

- Research various accounting software options.

- Compare features, prices, and customer reviews.

- Consider a free trial or demo.

- Evaluate the software’s ease of use and support.

- Make an informed decision based on your findings.

Choosing the right accounting software can simplify your business operations. It provides essential insights and helps manage your finances efficiently.

Credit: www.linkedin.com

Frequently Asked Questions

Do I Need An Accounting System For A Small Business?

Yes, an accounting system is essential for a small business. It helps track finances, manage expenses, and ensure compliance.

Do I Need To Use An Accounting Software?

Yes, using accounting software simplifies financial management, saves time, and reduces errors. It helps in tracking expenses, invoicing, and generating reports.

Can I Do My Own Accounting For My Business?

Yes, you can do your own accounting. Use accounting software for accuracy and efficiency. Consider consulting a professional for complex tasks.

When Should I Start Using An Accounting Software?

Start using accounting software as soon as you launch your business. It ensures accurate financial tracking and simplifies tax preparation.

Conclusion

Choosing the right accounting software can transform your small business operations. It simplifies financial management and saves you time. Evaluate your needs and budget to find the best fit. Investing in the right tool can lead to better financial health and growth.

Make the decision that benefits your business the most.